Most brokers believe trader acquisition is a conversion problem.

In reality, it is a confidence problem.

Between H2 2023 and December 2025, Invesnesia organically generated 4,000+ referred trading clients across multiple global brokers in Indonesia. This growth was not driven by aggressive promotions, short-term campaigns, or traffic arbitrage.

It was driven by something far less visible—but far more powerful: how confidence is built before a trader ever clicks “Register.”

This article shares what we learned from executing trader acquisition in the Indonesian market for 2.5 years—and why many broker growth strategies fail not because of weak products, but because they enter the decision process too late.

Contents

- 1 Executive Insight (TL;DR)

- 2 Understanding the Indonesian Retail Trader (A Commonly Misread Market)

- 3 Where Traders Actually Start (Hint: Not on Broker Websites)

- 4 The Invesnesia Acquisition Model (Simplified)

- 5 Why 75% Content + 25% Visibility Outperforms 100% Paid Exposure

- 6 The Attribution Trap Most Brokers Fall Into

- 7 Media Is Not a Vendor—It Is a Market Interpreter

- 8 What Successful Brokers Did Differently

- 9 The Strategic Question Brokers Should Ask

- 10 Closing Thought

Executive Insight (TL;DR)

-

Approximately 75% of registrations originated from conversion-focused articles

-

Banners and broker listings rarely convert directly, but play a critical role as trust and perception touchpoints

-

Indonesian traders do not choose brokers based on features alone—they choose based on confidence

-

Media is not a traffic source; it is a decision layer

-

Brokers that treat content, visibility, and trust as an ecosystem outperform those that optimize channels in isolation

Understanding the Indonesian Retail Trader (A Commonly Misread Market)

Indonesia is often described as a high-risk, leverage-driven retail trading market. While partially true, this description misses the most important dimension.

The Indonesian trader is defined by a paradox:

High opportunity-seeking behavior combined with deep fear of being misled.

Most retail traders:

-

start with relatively small capital,

-

have limited formal exposure to financial markets,

-

and carry psychological scars from past scams, illegal brokers, or “guaranteed profit” schemes.

As a result, trust is not assumed—it must be constructed.

Where Traders Actually Start (Hint: Not on Broker Websites)

In practice, Indonesian traders rarely begin their journey by searching for broker brands.

They start with questions such as:

-

Can I trade with small capital?

-

Is CFD or forex trading safe or legal?

-

Is broker X a scam or trustworthy?

-

Which broker is suitable for beginners?

Education and reassurance come first. Brand consideration comes later.

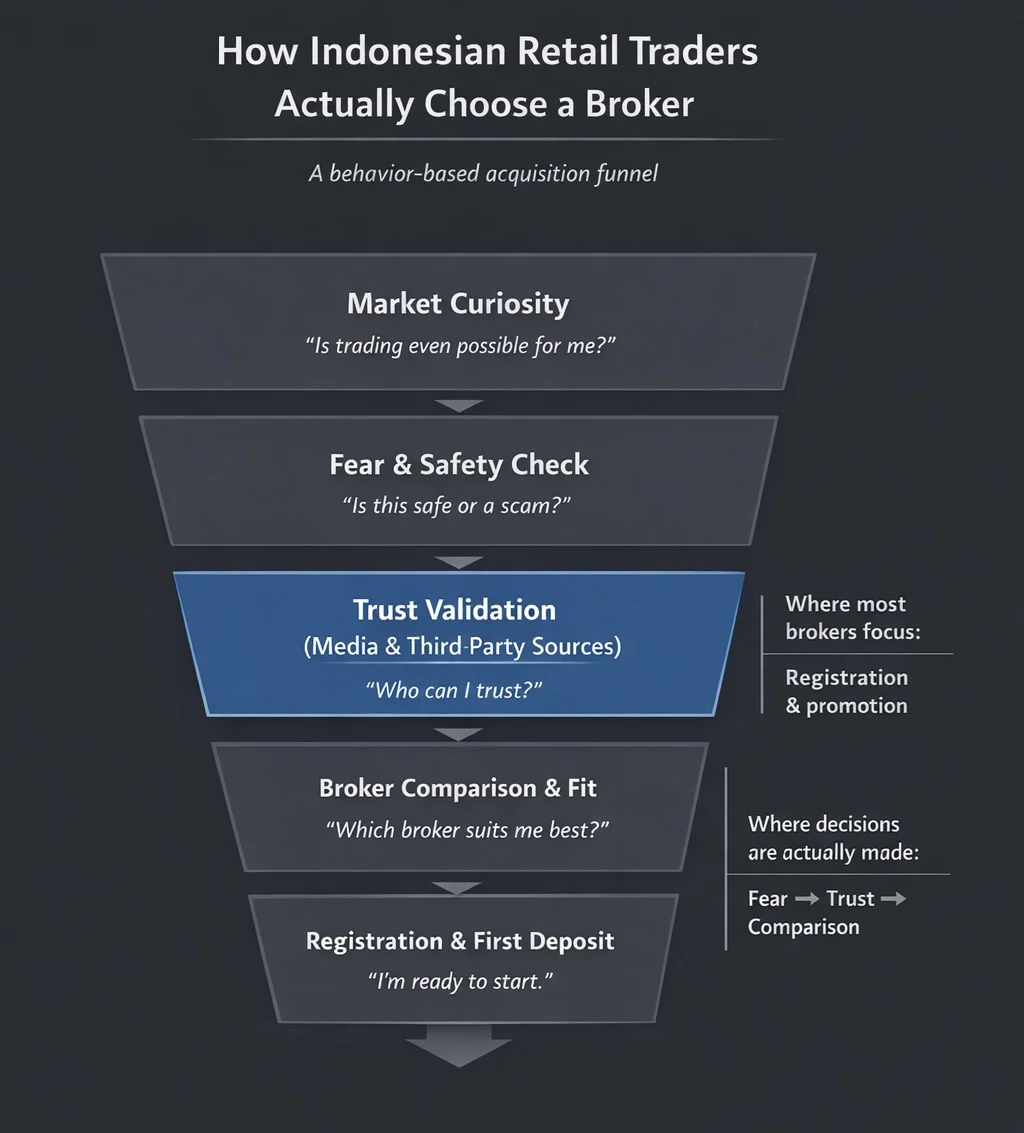

This behavior is best understood through a behavior-based decision funnel, not a traditional marketing funnel.

The key insight from this funnel is simple:

Most brokers focus on the bottom of the funnel, while decisions are made in the middle.

Fear, trust, and comparison—not promotion—determine outcomes.

The Invesnesia Acquisition Model (Simplified)

Our results were not driven by a single tactic. They emerged from a layered acquisition ecosystem.

Layer 1: Conversion Articles (~75% of Registrations)

These include:

-

long-form broker reviews,

-

objective comparisons,

-

problem-driven educational content with contextual CTAs.

Characteristics:

-

typically 1,200–2,500 words,

-

transparent about strengths and limitations,

-

written to inform decisions, not to sell.

These articles function as decision environments, not advertisements.

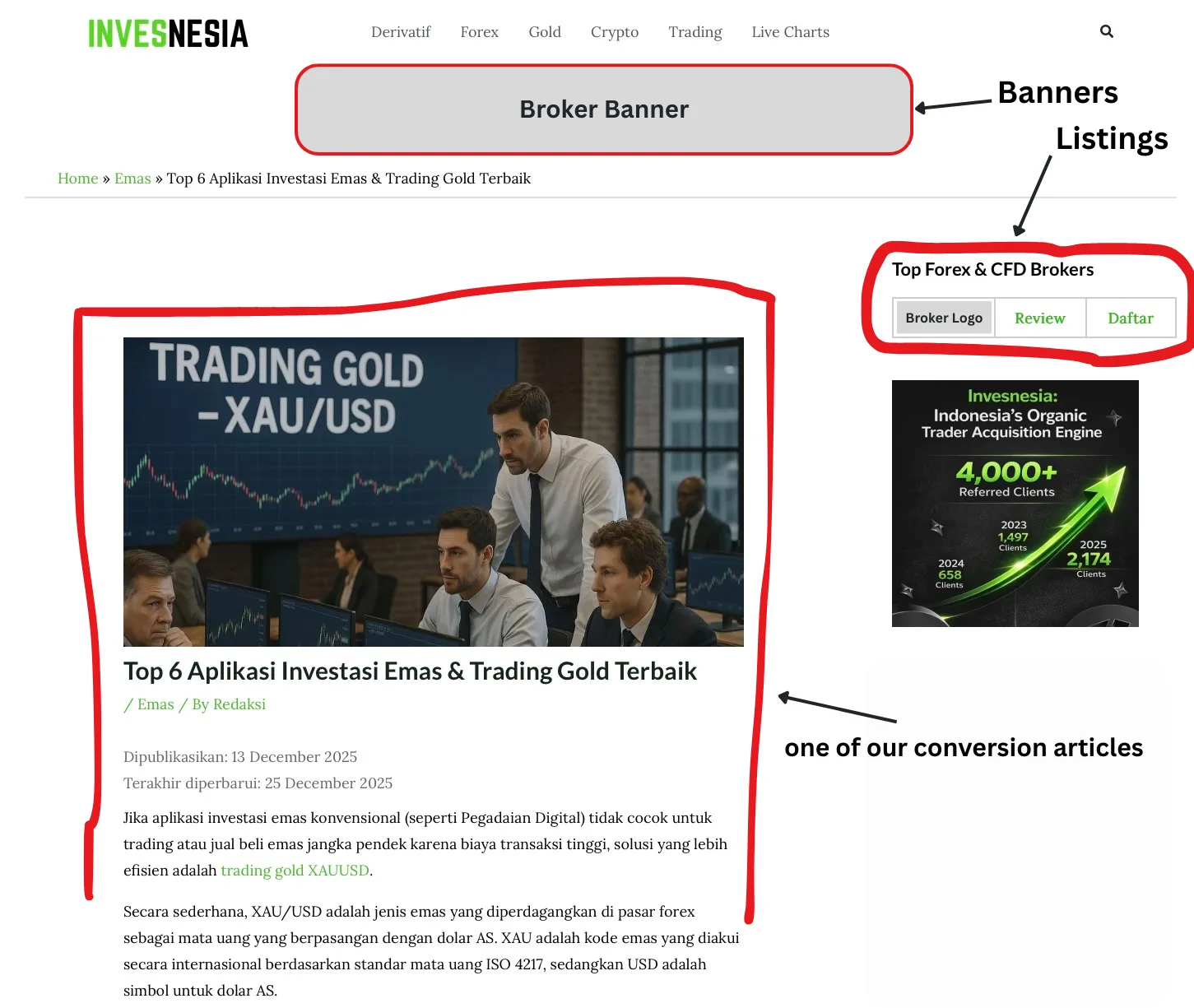

Layer 2: Banner Visibility & Broker Listings (High Influence, Low Attribution)

Banners and listings rarely appear as conversion drivers in analytics dashboards.

Yet their absence noticeably changes user behavior.

Their role is not persuasion—it is confirmation.

When traders repeatedly encounter a broker:

-

within objective editorial content,

-

alongside other established brands,

-

in a consistent and neutral media environment,

a powerful perception forms:

“This broker is legitimate, established, and widely used.”

This dynamic is best understood as an ecosystem, not isolated channels.

Confidence is built cumulatively, not instantly.

Why 75% Content + 25% Visibility Outperforms 100% Paid Exposure

A common question from brokers is:

“If articles convert best, why not focus only on content?”

Because human decision-making is not linear.

The Indonesian trader journey is fragmented:

-

multiple visits,

-

multiple devices,

-

multiple sources.

Articles may trigger action, but banners and listings:

-

reinforce memory,

-

normalize brand presence,

-

and reduce perceived risk.

Without these touchpoints, content works harder—and converts less.

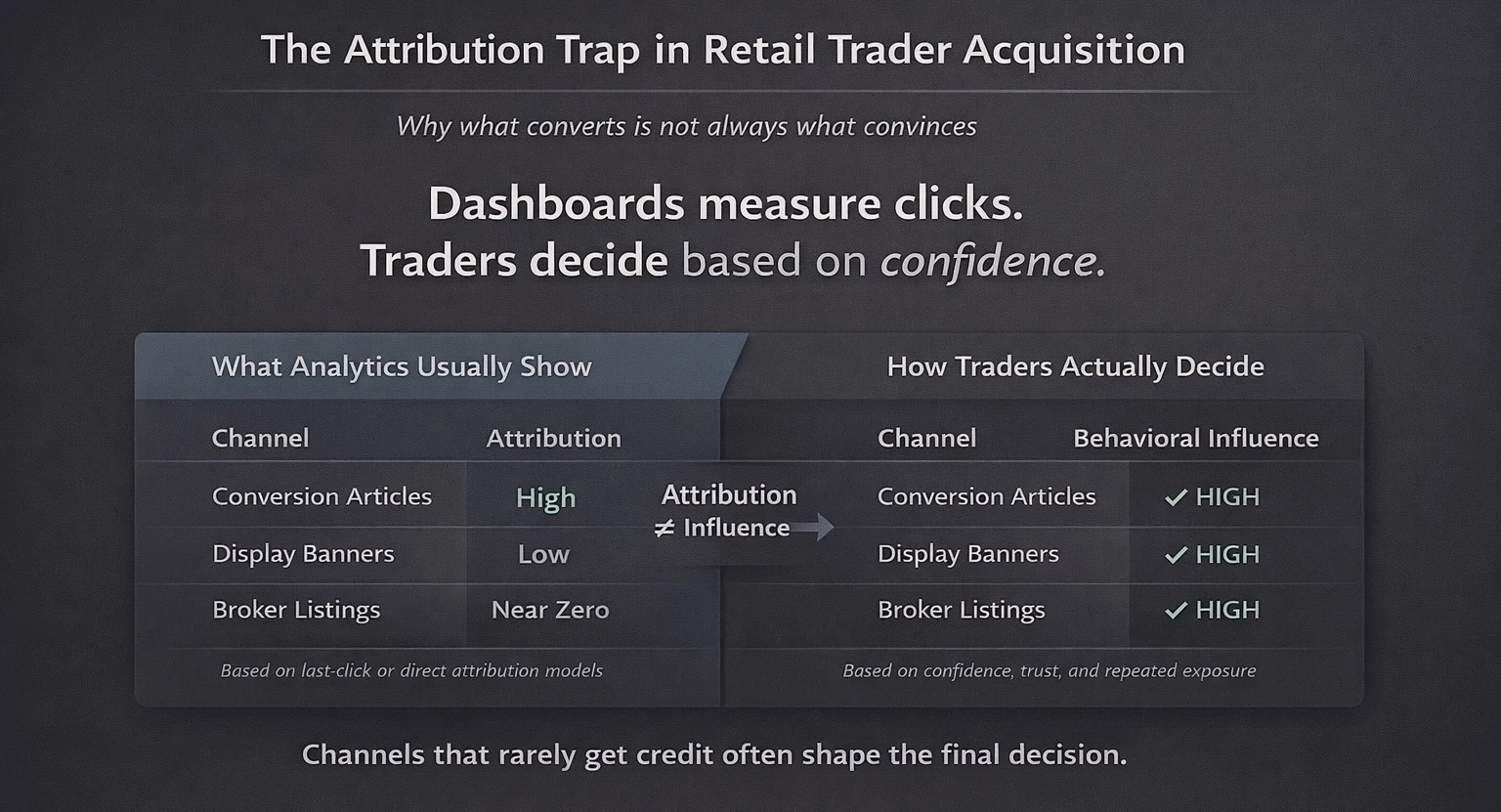

The Attribution Trap Most Brokers Fall Into

Most attribution dashboards are not wrong. They are simply incomplete.

Analytics typically show:

-

articles = high attribution,

-

banners = low attribution,

-

listings = near zero.

But this does not reflect how traders actually decide.

Dashboards measure clicks.

Traders decide based on confidence.

Channels that rarely receive credit often shape the final decision.

Media Is Not a Vendor—It Is a Market Interpreter

In Indonesia, media fulfills roles that brokers cannot replicate internally:

-

cultural interpreter,

-

trust proxy,

-

comparison facilitator,

-

third-party validator.

This role becomes even more critical as:

-

AI-powered search,

-

LLM-based recommendations,

-

and zero-click discovery

increasingly rely on media narratives, not brand claims.

In many cases, media becomes the broker’s voice in AI-driven discovery environments.

What Successful Brokers Did Differently

Across our ecosystem, brokers that performed well shared consistent traits:

-

patience with education-first funnels,

-

willingness to be compared objectively,

-

consistent presence rather than campaign-based exposure,

-

alignment between product reality and public narrative.

They did not attempt to control the story. They participated in it.

The Strategic Question Brokers Should Ask

The most important question is not:

“How much traffic can this media send?”

But rather:

“How does this media shape perception before, during, and after the click?”

Because in our experience:

Perception precedes performance.

Closing Thought

Invesnesia did not acquire 4,000+ referred trading clients by chasing conversions.

We earned them by:

-

understanding local psychology and behavior,

-

respecting trader intelligence,

-

and building an ecosystem where content, visibility, and trust reinforce each other.

Some brokers try to build this internally. Others partner with media that already lives inside the market.

Both paths are valid. But only one is faster.